February: The commercial month of LOVE

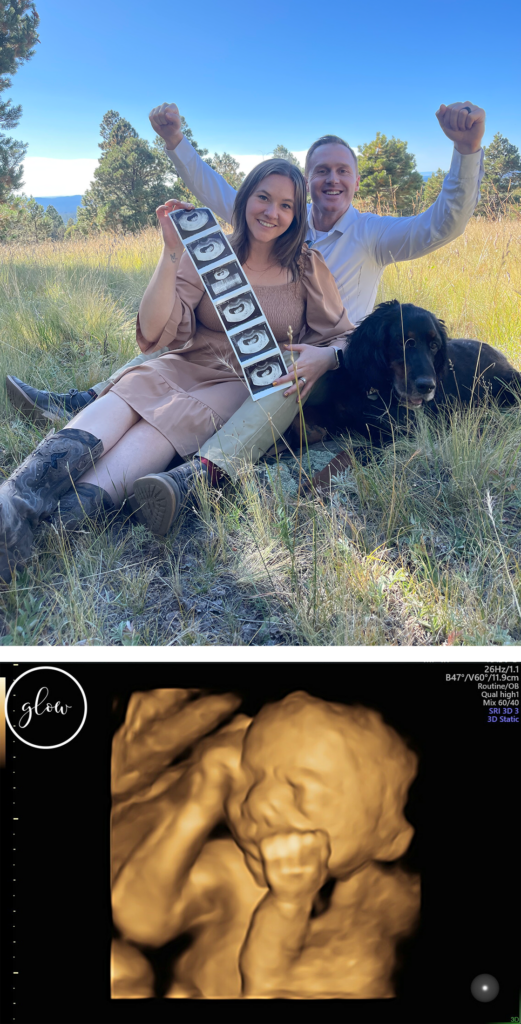

In your financial journey, we continually strive to bring you valuable insights and opportunities that can help secure a brighter future for you and your loved ones. Now for the GREAT NEWS! I am expecting my first grandchild in April. My husband and I are going to be gifting some very special things to this little nugget to set him up for success in the future!

In this edition, we are excited to discuss the compelling benefits of an Indexed Universal Life (IUL) insurance policy for your child—one like I will be setting up for my grandchild!!

- Financial Security for the Future:

An IUL is not just a life insurance policy; it’s a versatile financial tool that offers a death benefit while also accumulating cash value over time. By securing an IUL for your child, you provide them with a solid financial foundation that can support key life events, such as education, a first home, or even starting their own business. - Tax-Advantaged Growth:

The cash value component of an IUL grows tax-deferred, meaning you won’t pay taxes on the gains as they accumulate. This tax advantage can be a powerful wealth-building tool, especially

when started early in your child’s life. It creates a tax-efficient way to save for their future goals. - Flexible Premiums and Death Benefits:IUL policies offer flexibility in premium payments, allowing you to adjust the amount based on your financial situation. Additionally, you can modify the death benefit to align with your child’s changing needs over time. This adaptability makes IUL an excellent choice for those seeking a personalized and dynamic insurance solution.

- Participation in Market Gains with Downside Protection:

The “indexed” in Indexed Universal Life means that the cash value growth is tied to the performance of a stock market index. This provides the potential for higher returns compared to traditional life insurance policies, while still offering a safeguard against market downturns. Your child can benefit from market gains without exposing their policy to significant risks. - Legacy Planning and Wealth Transfer:

IULs facilitate seamless wealth transfer by providing a tax-efficient way to pass on assets to the next generation. By securing an IUL for your child, you not only protect their financial future but also establish a valuable asset that can be passed on to future generations.

An Indexed Universal Life insurance policy is a powerful and flexible tool that can lay the groundwork for your child’s financial success. By taking a proactive approach today, you are not only protecting your child’s future but also empowering them with financial security and opportunities.

Our team is here to answer any questions you may have about IULs or any other financial matters. Please don’t hesitate to reach out to us to discuss how this innovative solution can be tailored to meet your specific needs and goals.